VITA Program

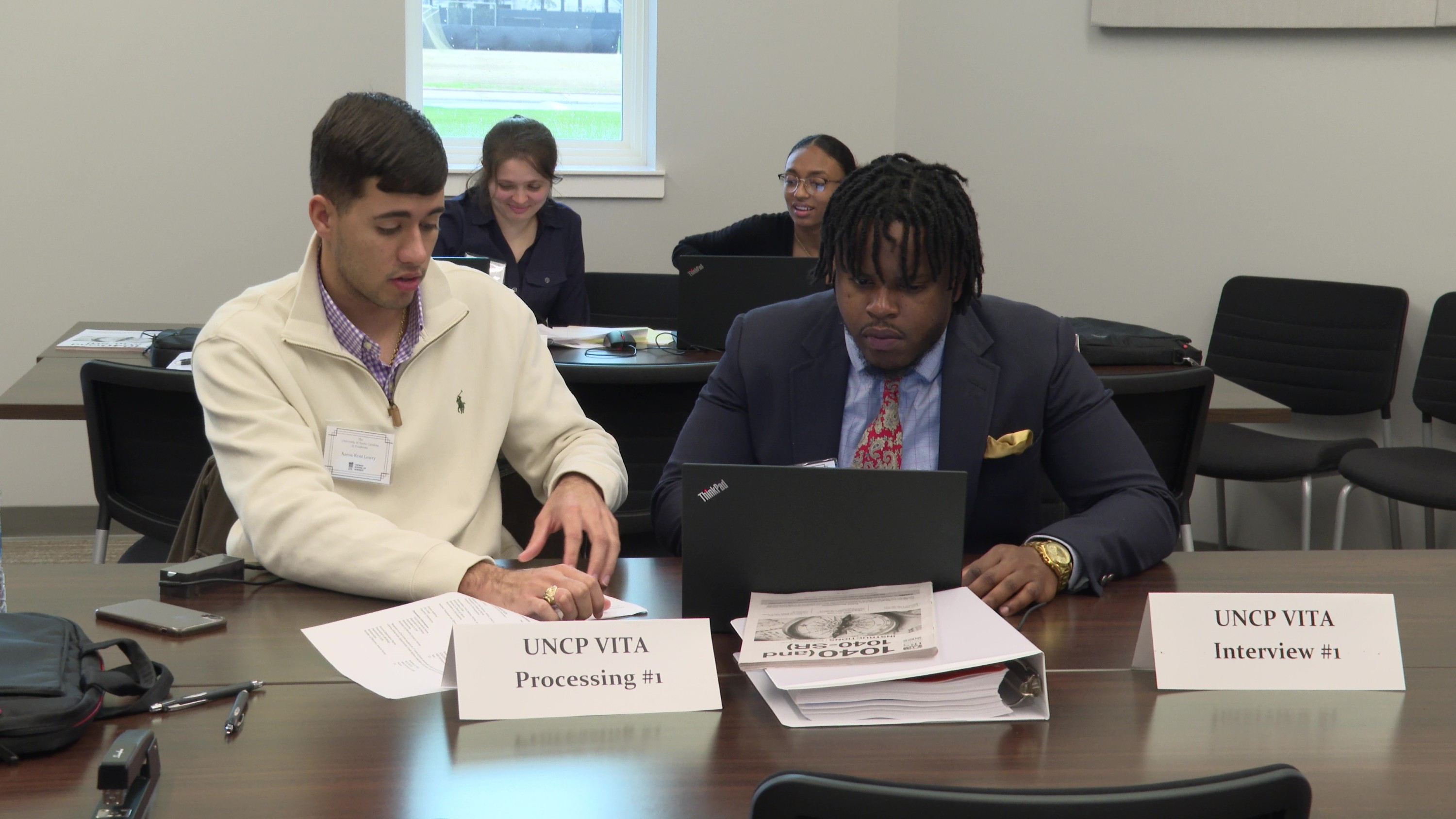

The Volunteer Income Tax Assistance (VITA) program offers free tax preparation services to qualifying individuals and families with household incomes below a designated level. Staffed by IRS-certified student volunteers under faculty supervision, the program provides hands-on experience for students while serving the community.

Services are available from 8 a.m to 5 p.m. on Mondays, during tax season, which is February through the filing deadline. Our office offers Walk-in Services only.

Prior to arrival, please complete the VITA intake form.

Frequently Asked Questions

Thomas College of Business and Economics

James A. Thomas Hall, Room 124

1 University Drive

Pembroke, NC 28372

Nothing! It's free of charge for qualifying community members.

- Income Limitation: Thomas College of Business and Economics VITA will not prepare returns for households making greater than $67,000 per IRS.

-

Form Limitations: UNCP VITA will not prepare these forms under normal circumstances:

- Form 1040 Schedules:

- Schedule C (Profit or Loss from a Business), unless you meet Schedule C-EZ criteria but your business expenses are between $5,000 and $10,000.

- Schedule D (complicated and advanced Sch Ds, i.e. those involving a high number of transactions)

- Schedule E (Rental Income)

- Form 1040 Schedules:

- Other forms:

- Form SS-5 (Request for a SSN)

- Form 2106 (Unreimbursed Employee Business Expenses)

- Form 3903 (Moving Expenses)

- Form 8606 (Nondeductible IRAs)

- Form 8615 (children under 18 with high investment income, AKA "kiddie tax")

- Other Limitations: Thomas School of Business and Economics VITA will not prepare military, international (US tax returns with foreign-source income) or prior year amended returns. If you need one of these services, contact another VITA site or a paid professional preparer.

- You must be a US citizen, permanent resident (green card holder), or visa holder to use our services.

Yes, however, it is very likely that you will need to drop off your documents and then return later to review them prior to submission to the IRS. In an effort to make sure that all returns are completed to our best ability, we have decided the drop off method is the best way to accomplish that goal. We will contact you when the return is ready for approval.

Every situation is uniquely different. Your return can take 30 minutes, or it can take over 1.5 hours. It all depends on your individual situation. We ask that you give us about 1.5 hours to prepare your taxes once the return preparation has begun. This is our estimated standard time allotted for every client. If you show up within an hour of closing time, we will not prepare your return that day.

If you are married and wish to file a joint return, then BOTH spouses must be present. Your spouse does not need to be there the entire time, but he/she needs to be there when you both pick a pin number (authorizing us to e-file on your behalf) and when you both sign the e-file authorization form. We cannot e-file a joint return for you if your spouse is not present. Also, please bring all your required documents with you, including the prior year's return.

Yes, we prepare state returns. We can also prepare and e-file all of your state returns.

We prepare prior year returns but not amended returns.

Yes. However, we strongly recommend that you e-file because it is much faster and much more convenient. You will also get a faster refund, usually within 2 weeks or so, when you opt for direct deposit.

If you do not want to e-file, then we can print out your return and give it to you to mail in. You have until the tax deadline, which is generally April 15th, to file the return and pay any outstanding taxes owed.

WE PREFER THAT YOU BRING COPIES AND ORIGINALS OF ALL DOCUMENTS.

WE WILL NOT HOLD ORIGINAL DOCUMENTS AND ALL WILL BE RETURNED TO YOU IMMEDIATELY.

Required: Photo identification (driver's license, state ID card, passport, visa or school ID card)

Required: Social Security cards (or ITIN cards) for taxpayer, spouse and all dependents (Copies of Social Security cards or ITN cards are acceptable.)

- A copy of last year's tax return, if available

- Wage and Earning Statement(s) from all employers: W-2

- Interest and Dividend Statement(s): 1099-INT, 1099-DIV

- Statements for other sources of income: W-2G, 1099R, SSA-1099, alimony, 1099-MISC, etc.

- Tuition statement for qualified education expense: 1098-T

- Receipts or other proof of purchase for required textbooks and other educational expenses

- Childcare provider's tax identification number (either the provider's SSN or the provider's business Employer Identification Number)

- Statements and receipts for itemized deductions (mortgage interest statements, property tax bills, charitable donation receipts, medical expense receipts, etc.)

- Receipts for business expenses

- A check, if using direct deposit for refunds (it must have the bank routing number and account number)

- If a couple is filing jointly and electronically, both spouses must be present to sign the forms